More than a third of landlords have never used a letting agent, new research from the Council of Mortgage Lenders into the profile of the buy-to-let sector has revealed.

An extensive report, including polling of 2,500 landlords, by the London School of Economics for the trade body found a similar proportion used an agent to manage all their properties and the remainder either used an agent to do some tasks, or for only some properties.

Buy-to-let landlords, those with mortgages, were more likely to use agents. Almost 40% of landlords – more among non-BTL mortgage landlords – said they were prepared to offer leases longer than one year. Most who did not offer them said there was no demand.

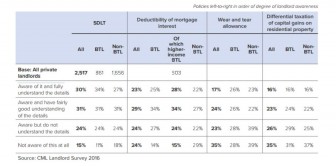

The report also looks at the impact of forthcoming taxation changes, and interestingly many are unconcerned, but this could be due to a lack of awareness.

Just 16% expect their income to fall in the next five years, and just another 16% and 12% of landlords said they would raise rents for new and existing tenants respectively.

Over the next 12 months a net 6% of landlords said they expected to reduce their portfolios, while over the next five years a net 14% expect to do so. Buy-to-let landlords were slightly less likely to say they planned to divest at a net 5% over the next 12 months and 11% over the next five years.

Only 21% of landlords overall cited any element of tax changes as part of their reason to sell. Unsurprisingly, however, among buy-to-let landlords tax featured as an element in their decision making for 36%, compared to only 13% of other landlords.

However, much of this optimism could be down to awareness or a lack of understanding.

A table in the report found that almost 40% weren’t aware of or didn’t understand the Stamp Duty changes, 48 % didn’t understand or were not aware of the mortgage interest reforms and 58% either did not understand or weren’t aware of the wear and tear allowance changes.

Additionally, 61% were either not aware of or didn’t understand the changes in capital gains treatment of property.

There is no breakdown of awareness among those using lettings agents and those managing their own property.

According to the research, just over half of buy-to-let landlords own more than one property, with the average size of a buy-to-let portfolio being 2.7 properties.

Just like home owners, landlords as a group are an ageing cohort. Back in 2004, only 24% of landlords were aged 55 or over, compared with 61% today, according to the report.

In terms of profile, the typical landlord owns property close to their home, is just as likely to manage their property themselves as to use an agent, and was originally motivated to become a landlord as a contribution to their pension provision, as an investment for capital growth and income, in preference to other investments, or to supplement earnings.

Paul Smee, director general of the CML, said: “While the overall findings are encouraging and offer a reassuring picture of relative stability, there is a certain irony in the researchers’ conclusions that the landlords who will be most affected by the government’s tax changes are those at the most professional end of the sector – those with large, leveraged portfolios.

“These landlords will be particularly hard hit by the changes in the treatment of mortgage interest and may choose to divest or moderate their property holdings.

“Given the Government’s long-standing interest in professionalising the sector, policymakers will need to be closely attuned to the risk of unintended consequences and, indeed, own goals.”

source http://blog.evolutionproperties.co.uk/2016/12/15/landlords-are-undeterred-by-buy-to-let-changes-lenders-claim/

No comments:

Post a Comment